Municipal Revenue Sharing - Eligibility Requirements

|

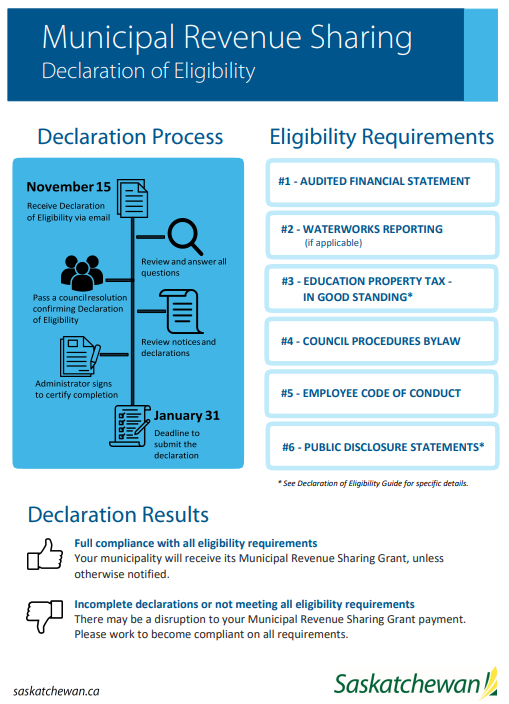

In order for communities to be eligible for Municipal Revenue Sharing, all municipalities must now be compliant with all 6 of the following requirements below and submit an online Declaration of Eligibility by January 31st of each year (even if not all 6 requirements are met).

There are six eligibility requirements: 1. Submission of the Audited Annual Financial Statement 2. Submission of the Waterworks Report (if applicable) 3. Ensure Education Property Tax is in Good Standing 4. Adoption of a Council Procedures Bylaw 5. Adoption of an Employee Code of Conduct (this link includes a guide and template). 6. Filing and annually updating Public Disclosure Statements for all council members. |

Background

The Ministry of Government Relations was directed to complete a review of the Municipal Revenue Sharing (MRS) Grant program in 2018-2019. One of the main objectives of the MRS Grant review was to provide recommendations on how MRS Grants could encourage effective local governance. To support this objective, the ministry implemented annual eligibility requirements for municipalities to receive their unconditional MRS Grants.

Questions?

If you have questions on how to meet or submit any of the requirements, please refer to the Declaration of Eligibility Guide, the Municipal Revenue Sharing website on saskatchewan.ca, or contact:

Ministry of Government Relations

306-787-2740

[email protected]

Ministry of Government Relations

306-787-2740

[email protected]

Additional Resources

- Advisory Services and Municipal Relations has developed a pre-recorded webinar to assist municipalities with completing the MRS Eligibility Requirements.

- Historical MRS figures: Click here to access historical, budgeted Municipal Revenue Sharing grant figures for all Saskatchewan municipalities, including the current fiscal year.

- Certified Administrator requirement: Under section 126 of The Northern Municipalities Act, 2010:

- 1) Every council shall establish a position of administrator of the municipality.

- 2) A person who holds the position of administrator must be qualified as required by The Urban Municipal Administrators Act.

- More information on how to become a certified Administrator: